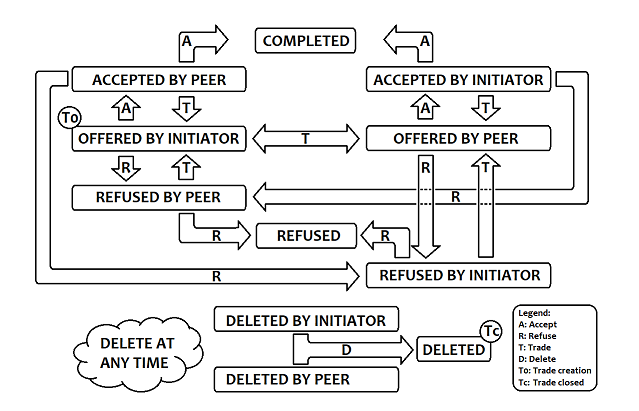

A trade is a transaction (agreement) in which 2 parties, an initiator and a peer, are involved to exchange coins.

A trade is bound by a double confirmation from both parties before being completed. Once ready to be completed, a transaction will be created with the coins selected for the trade. The trading capability is only available in the collector view.

A trade may have an infinite number of iterations and is only completed upon double confirmation from both parties. The double confirmation concept is based on successful consecutive acceptation of the terms of the agreement (transaction) by both parties.

An iteration of a trade is bound by 4 actions:

Whenever an action is taken, the other party of the transaction can always look at the state of the trade and the trade will be visible until it is deleted from its ongoing trade activity.

All coins cannot be traded at all time. If a coin is in locked mode, it cannot be part of a trade.

A completed trade becomes a transaction that can be looked at as part of the transaction history.

Trades have the capability to modify the market value of a coin.

Market value is the value attributed to a coin based on its latest trade. It fluctuates like the stock market where individuals decide to offer a price in return for the purchase of a share. Coins like any other physical asset follow the same rule of offer and demand. The Z ecosystem is no different except to the complexity added by potentially having multiple coins present in a trade. The market value does not impact the nominal value of the coin and is simply a valuation created by the traders.

For a trade to impact the value of a coin, the coin must be singled out in a trade so that it's value can be clearly identified. In other words, a single coin must be the only coin being traded by one party. That single coin's value then becomes the equivalent in terms of market value as the sum of the market values of all the coins it is traded for. This is based on the concept that both participant in trade have a fair estimate of the value of the single coin being traded and that there is a mutual agreement that the value is fair. In other words, both parties agreed on the new value of that coin based on the traded coins.

A second rule exist where in the presence of single coins on both sides of the transaction, the value of the lowest coin drives the value of the trade. In other word, a participant agrees that its coin is only worth the value of the other coin. That might seem unfair and questioned why the highest value was not taken as the fair value of the trade and the answer lies in staying conservative for the value of the coins and limiting the potential to manipulte valuation of a coin.

Below are explanations for different scenarios faced by traders when evaluating the resulting market value of their coin.

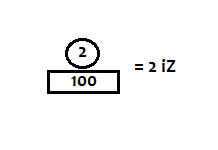

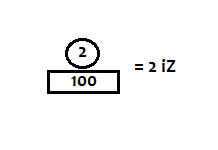

To simplify the number representation, all coins traded below are mZs, meaning their nominal value is 100 iZ and can be decomposed in 100 coin bits (nominal units, iZ).

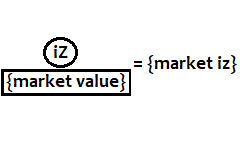

|

| iZ stands for the number of coin bits (nominal units, iZ) traded for that specific coin. To simplify the explanations below, only one term will be used and will be referred to as coin bits. {market value} is the market value of the whole coin {market iZ} is the sum of market value of all the coin bits being traded |

| Trader #1 sends | Trader #2 sends / Trader #1 receives | Trader #2 receives |

|---|---|---|

|

|

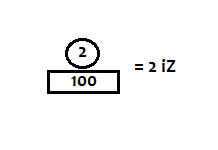

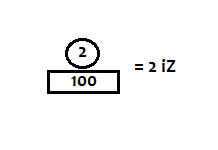

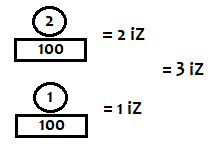

No change in value  |

| Explanation: Trader #1 sent 2 coin bits of a coin worth 100 iZ which is equivalent to what it received from trader #2, composed of 2 coins that were each sending 1 coin bit and both were worth 100 iZ resulting in no changes of value for any coins involved in the trade. | ||

|

|

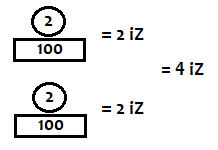

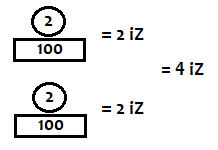

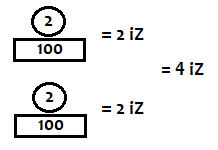

|

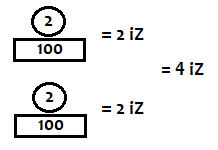

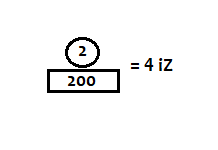

| Explanation: Trader #1 sent 2 coin bits of a coin worth 100 iZ which is less than what it received from trader #2, composed of 2 coins that were each sending 2 coin bits for coins worth 100 iZ. Trader #2 then offered a market value of 4 iZ of its coins to receive 2 iZ of trader #1's coin. The value of the parts of the coin of trader #1 is then worth 4 iZ which changes the value of the whole coin to be worth 200 iZ. The coin doubled in value. Trader #2 sent 4 iZ and received back a value of 4 iZ. Trader #1 sent 2 iZ but received 4 iZ because the market value of the 2 iZ sent was deemed worth 4 iZ. The coin from trader #1 now in the hands of trader #2 is now worth more than it used to. Anyone that owns part of that coin is benefiting from the new market value of that coin. | ||

|

|

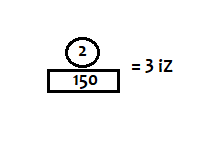

|

| Explanation: Trader #1 sent 2 coin bits of a coin worth 100 iZ which is less than what it received from trader #2, composed of 2 coins where 2 coin bits of a coin worth 100 iZ were sent and 1 coin bit of a coin worth 100 iZ was sent. Trader #2 then offered a market value of 3 iZ of its coins to receive 2 iZ of trader #1's coin. The value of the parts of the coin of trader #1 is then worth 3 iZ which changes the value of the whole coin to be worth 150 iZ. The coin increased by 50% in value. Trader #2 sent 3 iZ and received back a value of 3 iZ. Trade #1 sent 2 iZ but received 3 iZ because the market value of the 2 iZ sent was deemed worth 3 iZ. The coin from trader #1 now in the hands of trader #2 is now worth more than it used to. Anyone that owns part of that coin is benefiting from the new market value of that coin. | ||

|

|

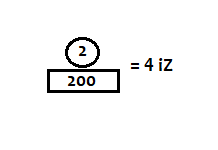

|

| Explanation: Trader #1 sent 2 coin bits of a coin worth 1000 iZ which is more than what it received from trader #2, composed of 2 coins that were each sending 2 coin bits for coins worth 100 iZ. Trader #2 then offered 4 iZ of its coins to receive 20 iZ of trader #1's coin. The value of the parts of the coin of trader #1 is then worth 4 iZ which changes the value of the whole coin to be worth 200 iZ. The coin decreased by 80% in value. Trader #2 sent 4 iZ and received back a value of 4 iZ. Trader #1 sent 20 iZ but received 4 iZ because the market value of the 20 iZ sent was deemed worth 4 iZ. The coin from trader #1 is now worth less than it used to. Anyone that owns part of that coin is impacted by the new market value of that coin. | ||

|

|

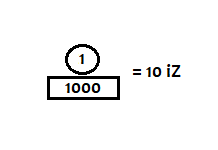

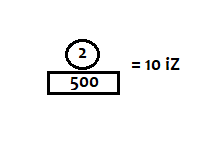

|

| Explanation: Trader #1 sent 2 coin bits of a coin worth 1000 iZ which is more than what it received from trader #2, composed of 1 coin bit of a coin worth 1000 iZ. Trader #2 then offered 10 iZ of its coin to receive 20 iZ of trader #1's coin. The value of the parts of the coin of trader #1 is then worth 10 iZ which changes the value of the whole coin to be worth 500 iZ. The coin decreased by 50% in value. Trader #2 sent 10 iZ and received back a value of 10 iZ. Trader #1 sent 20 iZ but received 10 iZ because the market value of the 20 iZ sent was deemed worth 10 iZ. The value of the coin from trader #1 is now worth less than it used to. Anyone that owns part of that coin is impacted by the new market value of that coin. The coin received by trader #1 is unchanged in value. | ||

|

|

No change in valuation |

| Explanation: Since multiple coins were sent, it is not fair to assess a value of what the traders estimated to be the real value of each individual coins and would become very subjective. The same would happen in a sports team where 2 players are traded from team A for 4 players of team B. In this trade, maybe 1 of the 4 players in team B is a superstar while the 3 others are weaker while the 2 players from team A are average players. The same trade could be seen as being 1 superstar and 1 weak players in team A traded for 4 average players of team B. Those kind of trades are very subjective and that complexity for coin trading is impossible to evaluate. As such, any trade involving multiple coins are not considered for determining the market value of every single coins that are part of the transaction. In this exmaple, trader #2 received coins worth 4 iZ while only sending coins worth 2 iZ. The market value of his pouch increased by 2 iZ while the one of trader #1 decrease by 2 iZ. | ||